Cook County West Township Reassessment – More of the Same from Assessor Kaegi's Office

- Kane & Co.

- Jul 28, 2021

- 2 min read

West Township, a township in Cook County last reassessed in 2018, is one of the eight Chicago townships being reassessed this year. This is the second of Township reassessments for this triennial reassessment, and true to form, Assessor Kaegi has delivered on his promise to impose higher valuations for commercial and industrial properties, all in the time of COVID.

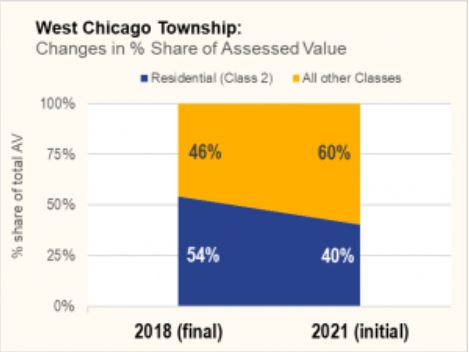

The Shift Explained: In 2018, Class 2 Residential properties (single family, multi-family six units or less and condos) in West Township totaled $3,235,583,770 of Assessed Value. After the reassessment, the total Assessed Value for Class 2 Residential property is $4,006,377,398 – reflecting an increase of 24%. In 2018, all non-Class 2 properties totaled an Assessed Value of $2,748,116,779. After the reassessment all non-Class 2 properties totaled an Assessed Value of $5,921,686,198 – reflecting an increase of 115%. In 2018, Class 2 residential property’s share of the Township’s Assessed Value was 54%. After this year’s reassessment, Class 2 property’s share of the Township’s Assessed value decreased to 40%. This indicates a shift of 14% of the Township’s total Assessed value to Commercial and Industrial Property. The only effective way to undo the shift is to appeal the assessment to the Assessor, the County Board of Review, and if necessary Circuit Court or the Illinois Property Tax Appeals Board.

Appeal, Appeal, Appeal: It is important to note that these values are not final. Before tax bills are issued in 2022, property owners will have the opportunity to make their case for reductions in value before the Assessor as well as the County Board of Review. The deadline to file an appeal with the Assessor’s Office for West Township is August 23, 2021. For more information on the West Township Reassessment, click here.

If you are an owner or tenant of a commercial or industrial property in West Township, and would like a complimentary property analysis, please do not hesitate to contact us.

Comments